As a business owner, there are many factors to consider when it comes to protecting your investments and assets. One natural disaster that often gets overlooked is flooding. Whether your business is located in a flood-prone area or not, it’s essential to understand the importance of having flood insurance in place.

The Reality of Flood Damage

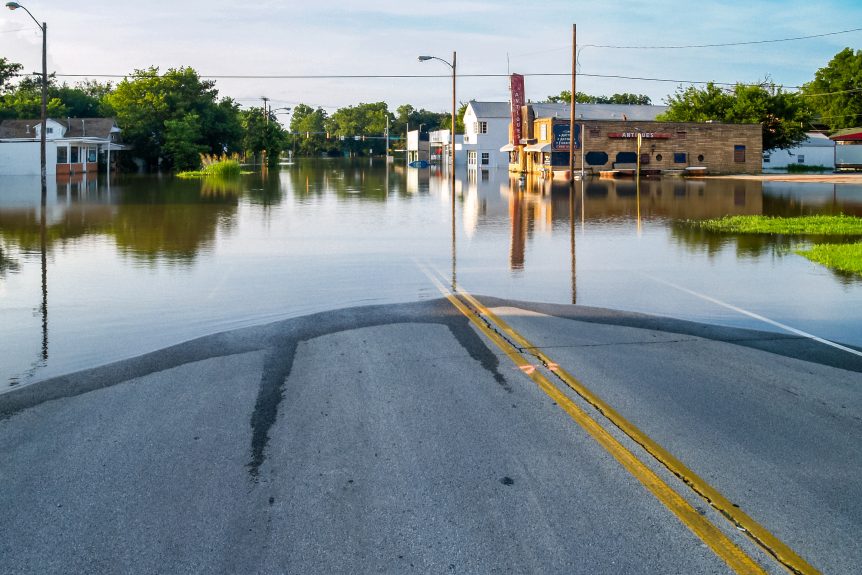

Floods can cause extensive damage to businesses, resulting in significant financial losses and even the closure of operations. The effects of flooding go beyond just water damage; there may also be damage to machinery, equipment, inventory, and other valuable business assets. Cleanup and restoration costs can quickly add up, putting a strain on your finances.

Standard Insurance Policies May Not Cover Flood Damage

It’s crucial to note that most standard commercial property insurance policies do not include coverage for flood damage. Fire, theft, and certain natural disasters may be covered, but flood-related losses typically require a separate flood insurance policy.

Understanding Your Business’s Risk

To determine if your business needs flood insurance, it’s essential to assess the level of risk it faces. Factors to consider include the location of your business, proximity to bodies of water, and the history of flooding in the area. Consulting with a qualified insurance professional can provide you with valuable insights into the flood risk specific to your business.

Benefits of Flood Insurance

Having flood insurance for your business provides several key benefits. First, it protects against the financial losses associated with flood damage, ensuring that you can recover and continue operations in the event of a flood. Second, it provides peace of mind, knowing that you have coverage specifically designed to address the risks of flooding.

Risk Mitigation and Preparation

Alongside obtaining flood insurance, it’s essential to implement risk mitigation measures to minimize the potential impact of flooding on your business. This can include things like investing in flood barriers or sandbags, elevating equipment or important assets, and establishing emergency response and evacuation plans.

Conclusion

Flooding can wreak havoc on your business, leading to significant financial losses if not properly insured. Assessing the risks, understanding the limitations of your current insurance coverage, and securing a flood insurance policy can provide the protection and peace of mind your business needs. Protect your investments and ensure the continuity of your operations by taking proactive steps towards flood preparedness.