Industry: Industrial Manufacturing

Annual Revenue: $400M

Scope: Multi-state Operations, Global Supply Chain

Coverage Lines: Property, Casualty, Liability, Work Comp, Cyber, Business Interruption, Specialty Lines

A large industrial manufacturer was undergoing a leadership transition and preparing for its annual insurance renewal. With a recently promoted COO focused on driving operational efficiency, the executive team took a fresh approach to their risk management strategy. They issued an RFP and engaged several brokers to quote the full commercial insurance program. After reviewing the proposals, the leadership team chose to work with a single broker who came in with the lowest total premium — nearly 12% below the next bid. The company saw this as a clear financial win. But what they failed to understand was this: they didn’t just choose a broker — they chose a strategy.

The Oversight

What the leadership team didn’t realize — and didn’t know to ask — was that the policy terms in the lower-cost quote included:

-

Narrower definitions of covered perils

-

Sub-limits buried deep in endorsements

-

Exclusions for critical exposures like equipment breakdown, non-owned supplier disruptions, and certain cyber events

-

No manuscripted coverages to account for their specialized operations or contractual obligations

No one on the internal team had the insurance expertise to interpret the dense policy language, and the broker didn’t walk them through the fine print. The company assumed all brokers were quoting the same coverage — just at different prices. They weren’t.

The Loss Event

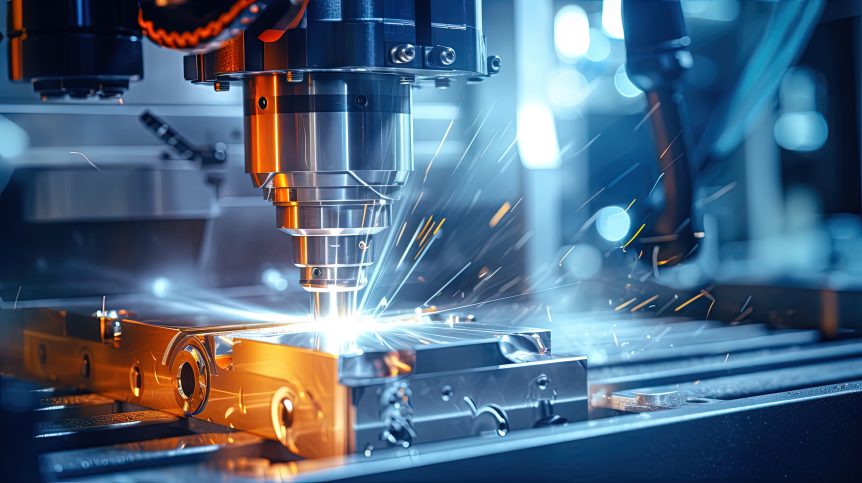

Nine months into the policy, a power surge damaged several CNC machines and brought production to a standstill. As the company activated its business interruption claim, the fallout began:

-

The equipment breakdown exclusion meant no coverage for the damaged machines.

-

The business interruption claim was denied because the event didn’t meet the policy’s narrow trigger definition.

-

Dependent property coverage had been excluded, so delays from a key overseas supplier weren’t reimbursed.

-

A simultaneous cyber incident affecting vendor communications was ruled out due to a policy exclusion tied to third-party software.

To make matters worse, the company discovered that many of these issues had been flagged by other brokers during the RFP process, but hadn’t been understood — or prioritized — by leadership.

The Outcome

The incident led to more than $10 million in out-of-pocket losses, including:

-

Lost production and revenue

-

Contractual penalties from missed customer deadlines

-

Legal costs tied to disputes with third parties

-

Costs to repair and replace machinery

The company had insurance — but not the right insurance. They had placed coverage based on price, without the expertise to evaluate exclusions, sublimits, or coverage nuances. And by the time they realized it, it was too late.

Key Lessons

-

Price is not protection. A low premium often means less coverage — and without understanding the language, exclusions can be costly.

-

Policy language matters. Without guidance from an experienced broker who explains the details, critical gaps can go unnoticed.

-

Assumptions are dangerous. Not all quotes are equal, and assuming coverage is “standard” puts businesses at risk.

-

Expertise is essential. Large, complex operations require insurance partners who understand both industry risk and coverage structure.